To drive business, attract new clients, and retain existing ones, financial institutions must invest in improving their customer experience. One of the best strategies to achieve that is tracking and keeping up with emerging industry trends. Enhancing your customer experience is important not just because it will increase customer loyalty and satisfaction but because customers also expect it.

According to research compiled by CXINDEX, 86% of customers are willing to pay extra for a better customer experience, and 64% will recommend your brand if you offer an amazing experience. This is why it’s so important for financial institutions to know the trends and expectations their existing and potential customers have regarding the customer experience.

In this article, we’ll share five customer experience trends that financial institutions should keep up with in 2023.

What is Customer Experience in the Financial Industry?

Customer experience, also known as CX, is a customer’s overall experience when interacting with an institution’s products or services and their perception of the business and its values.

CX is becoming increasingly important to the financial industry and all businesses as the differentiating factor. Research shows that over 80% of companies compete primarily based on CX. Improving customer experience goes beyond being on call 24/7 to address clients’ issues. It requires that you digitize your banking services to be convenient, easy to use, personalized, and secure.

A good CX is customer-centered. You have to predict the customer’s expectations, constantly measure your CX performance, and solicit feedback from them.

5 Customer Experience Trends of 2023

A strong customer experience is critical in helping financial institutions build lasting relationships with their customers, increase revenue, and stay ahead of the curve. Whether you are running a bank or credit union, offering great CX is the best way to protect your reputation.

Studies show that financial institutions that lead in CX have a higher recommendation rate and a higher share of deposits, while those with declining CX risk losing 12.5% of their share of deposits. One of the best ways to ensure you stay in business and keep your CX game sharp is to follow trends. And this is because of two main reasons:

- You will know what customers want and address their needs.

- You will know what competitors are doing, and you can use them as a benchmark to grow your business.

With that out of the way, here are five customer experience trends that will shape the financial industry in 2023

1. Humanizing the digital experience

As businesses focus on digitization and customer interaction becomes more automated, customer experiences lose a personal touch. Companies can no longer connect with clients on a human level, and as a result, clients feel neglected. Institutions will be looking to humanize their digital experience to increase customer satisfaction and build loyalty in 2023.

Having a humanized digital CX has many benefits. For starters, you will be able to deliver unified support and messages. This will enable you to track the customer journey and behaviour more efficiently. It also allows you to create a more customer-focused experience. You can proactively engage with customers by soliciting feedback, sending timely messages, and starting meaningful conversations.

To humanize your digital customer experience, you need to map your client’s journey. Customers typically engage with your brand on different touchpoints. Some will want their issues addressed on other channels, from chatbots, social media, voice calls, or video calls. A humanized digital CX should allow you to deliver a consistent experience through all these channels. It will also help you know what the customer expects depending on where they’re on their journey.

Another way to humanize your institution is to build a brand image. This involves including customers in your plans, constantly engaging them on social media, telling your brand stories, and offering education. For example, you can teach your customers how to save or build a good credit mix that matches what 90% of lenders in the market use to make credit decisions. Doing this sends a message that you value your customer.

2. More self-service choices for the savvy clients

Your customers are different. Some will want to deal with customer representatives face to face, and others prefer calls. But one group that has been growing is customers who want to serve themselves. In 2023, financial institutions will catch up to this trend that has taken root in many other industries.

In CX, self-service is the aspirational experience where service is provided to clients with no friction points along their journey. Customers can sort out their issues without dealing with a skilled representative. In most instances, they just have to follow prompts. Self-service makes the CX experience more interactive for the users and can save you tons of money.

Offering this option allows financial institutions to improve the experience of their customers. Self-service is fast, is available round the clock, and provides a consistent experience. Some common examples of self-service that will shape CX in the financial industry include:

- Onboarding process: Digitization of this exercise can help you convert new customers by allowing them to sign up, go through the KYC process, and start using your product and service without visiting your office or talking to a representative.

- Help Center: This will serve as a database or library that contains materials, content, tutorials, FAQs, etc., that can help answer customers’ questions.

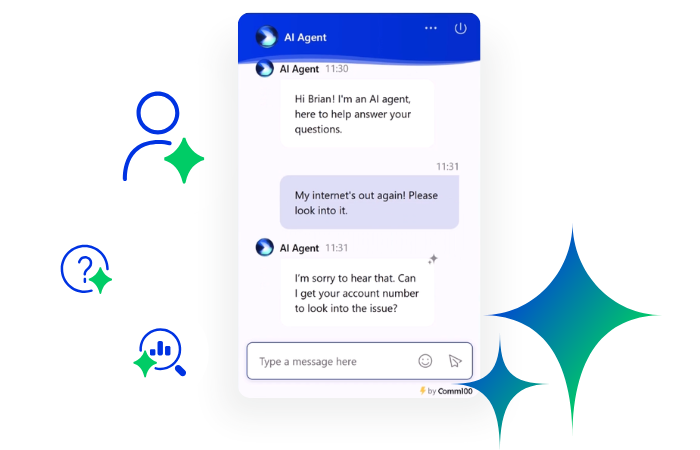

- Chatbots: You can use AI-powered widgets to answer common questions for website visitors and customers using known or pre-loaded playbooks and client data.

3. Personalizing the customer experience

Customers’ expectations have seen significant changes over the last few years, and going into 2023; their demands are more clear than ever. They expect relevant and customized CX from their financial institutions. If you want to boost your customer retention rates, increase conversions, and turn your clients into brand ambassadors, you must personalize your CX.

Personalized customer experience is a marketing strategy that helps you tailor and customize your communication with each customer. It requires that you know, understand, and remember who your customer is. Personalizing your customer experience allows you to meet customers’ individual requirements and offers the best channel to differentiate your institution from competitors.

To personalize your customer experience, you first need to group your customers into micro-segments based on their shared qualities. You can group them according to their behaviour, demographics, or where they’re in the customer journey. This will enable you to offer them relevant communications, focus on the hot prospect, and offer appropriate customer support.

Other steps you can take to personalize your CX is providing customer support across all channels, listening to your customers, and using the data they give you to customize your communications.

4. Omnichannel experiences

This refers to providing clients with an integrated and streamlined experience across multiple channels. For instance, when shopping for a trading platform, most customers look for online trading platforms that come with features such as innovative social features.

Omnichannel experiences are important to financial institutions for two reasons. It allows you to keep track of the customer’s journey by providing deep insights and increasing customer retention rates by keeping clients engaged.

Omnichannel experiences are important because customers have grown to accept them. First, customers want it. In fact, over 60% of customers expect you to know their needs. Second, customers want consistency. Your messaging across the board should be uniform.

To conduct an omnichannel CX, you first need to know your customers. This will allow you to group them into segments and market to them individually. You’ll be able to map their customer journey, identify the touchpoints, and provide support whenever they ask. To deliver the perfect omnichannel experience, you must perfect both your digital and traditional CX. Have your chatbots ready and human representatives ready to answer calls as well.

5. Enhance employee experience for greater customer experience

Your employees play a vital role in connecting with your clients, whether through a phone call or a face to face communication. Your employees, especially your customer service representatives, are some of the closest people to your customers. And most importantly, they’re the people who will define how prospects view you.

To improve CX, financial institutions must implement incentives that enhance employee experience. When employees are satisfied, they will connect better with your prospects, stay loyal to your brand, and build trust to retain customers.

Employees have significant value as brand ambassadors and are the only human touchpoint between your customers and your institution. How much a customer is satisfied will be determined by how well your employee serves them. The entire digital process might have been smooth, but employees must convince the prospects that you are committed to providing the level of CX they expect. Going into 2023, businesses will be looking to unify their EX and CX to create total experiences to help them achieve their objectives.

Wrap-up: Improve your customer experience

Improving CX can increase customer satisfaction, loyalty, and advocacy. Providing high-quality customer service is essential for improving CX. Consider training your employees on customer service best practices, and implement processes and systems to ensure that customers receive timely and helpful assistance.

Customers appreciate when companies make it easy for them to do business. Consider streamlining your processes, providing multiple channels for customers to contact you, and making information and resources easily accessible.