Credit union member expectations are changing and changing fast. While telephone and email were once the go-to support channels, today’s members now expect more. The only way to keep up and meet these expectations is through digital transformation.

In this article, you’ll see why credit union digital transformation must be a priority and how credit unions can accelerate their digital transformation with the introduction of digital customer engagement software and tools.

To understand why credit union digital transformation is crucial, it’s important to first understand how member expectations and demographics are changing. Although credit union members skew demographically older, with an average age of 45 worldwide, they’re increasingly tech savvy. Current members are now much more comfortable with digital services than in the past.

Members that traditionally sought in-branch support now expect digital services to supplement their member experience. These ‘phygital’ members using both physical and digital services have also grown dramatically with the service disruptions of the Covid-19 pandemic. In 2021, US banking customers that identified as ‘phygital’ grew by 17%.

The need to shift towards digital support is also increasing as Millennials and Gen Z reach financial maturity. These future members are digital-first and already expect digital services from their financial institutions. Research from BAI found that 62% of Millennials and 61% of Gen Z said they would switch their primary bank account for a better digital experience.

To satisfy these changing member demands, credit unions must offer digital member support across a variety of digital channels. The next sections will show you the tools that are needed to provide outstanding digital support and progress on your credit union digital transformation journey.

Step 1: Introduce live chat software

As we’ve seen, members want to connect with their credit unions digitally, conveniently, and quickly. To meet all of these needs, credit unions must introduce live chat software.

The key benefit of live chat is its speed. Members can send and receive messages in real-time, getting resolutions to their problems more quickly than any other channel. What’s more, live chat allows agents to be 3x more productive than telephone when supporting members thanks to chat concurrency – the ability to handle multiple chats simultaneously. This improved productivity means reduced wait times for members and increased capacity for credit unions.

Importantly, live chat also ensures credit unions can keep a personal and human touch to their member support, as Cabrillo Credit Union found out when they implemented Comm100 Live Chat:

“Live chat can be very personal. Often people think you can’t engage the same way you can on the phone, but you can. It’s fun, members like it, and you just have to not be afraid to engage and put a little humor or happiness into someone’s day through the written word.” – Cabrillo Credit Union, Kelli Davis, Assistant VP of Member Support

Live chat support also reduces support costs. Compared to traditional voice support, live chat is less than 1/3 the cost.

Step 2: Embrace automation

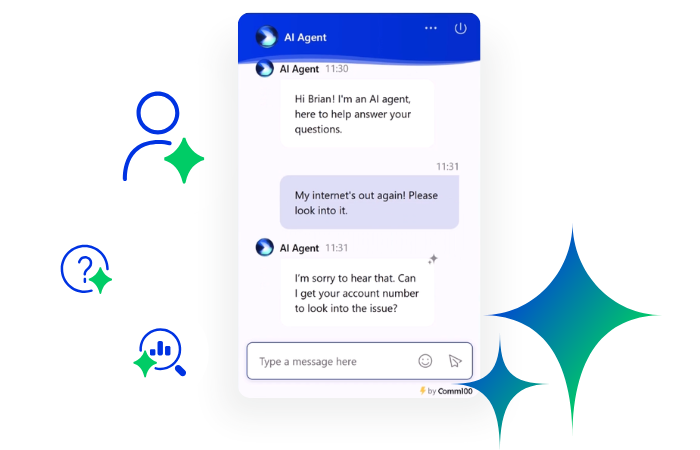

The next step to accelerate credit union digital transformation is to introduce automation with chatbots. Once integrated within your live chat software, chatbots can handle as much as 80% of all queries.

Many credit unions begin their chatbot journey with taskbots. These are code-free, simple to build chatbots that guide customers through a series of questions and answers to resolve their query or complete a task. Here are some examples of what task bots can do:

- Answer simple and common FAQs

- Direct members to relevant pages for answers

- Book meetings

- Capture contact information from members

- Route members to the best agent for the job.

Task bots are often a good place to start for credit unions who are wary of chatbots because they are incredibly easy to build – you can simply choose from a selection of templates or build your own with an intuitive drag-and-drop functionality.

Once you’re feeling comfortable about automation and bots, it’s time to introduce AI chatbots. AI chatbots are powered by artificial intelligence so rather than following a pre-set range of questions, they can understand intent and complexities of language. This means they can engage in more natural conversations and handle more questions – Comm100 AI Chatbot can handle up to 80% of queries without any human interaction.

The benefits of this for credit unions are huge. Firstly, with a chatbot in place, you can provide 24/7 support to members without the unattainable cost of night-time agents. Secondly, with less questions directed at human agents, these agents can spend more time on complex questions, giving members the time and care that they expect. And with the automation of bots, members get instant responses no matter the time of the day.

The next and crucial step in accelerating credit union digital transformation is adopting omnichannel member engagement software. Omnichannel platforms connect every communication channel (and the data within) together within one platform. This has two major benefits.

Firstly, this gives members the flexibility to reach out however they want – live cat, social media, SMS, or email – and receive the same great service in return. This improves CX while also increasing engagement with potential members.

Secondly, omnichannel engagement platforms help credit unions to provide personalized support. With every channel and all communication history pulled together into one platform, agents have access to a wealth of data about every member. With this data at hand, agents can provide far more personalized and genuine support. You can also integrate a CMS too to bring even more data into the equation.

For credit unions wanting to meet their members’ customer service expectations, omnichannel member engagement is essential.

Credit unions are already seeing the benefits of digital transformation. In this section, we’ll take a look at two credit union success stories and see how they have introduced live chat and chatbot software to accelerate digital transformation.

Lake Michigan Credit Union

Lake Michigan Credit Union (LMCU) was founded in 1933 and has grown to become one of the largest credit unions in the United States. LMCU has traditionally taken a conservative approach to change management, and in 2015 they saw that competitors were further ahead on the journey to digital transformation. To keep up with the competition, LMCU knew that they needed to introduce live chat.

By introducing live chat, LMCU members now receive faster and more accessible support compared to traditional phone and email channels. Members also love the convenience of chatting with an agent while on-the-go using the mobile app:

“We’ve received nothing but positive responses. Members love the ease of being able to be anywhere and connect with us over chat instead of having to go into a branch or calling in. They really enjoy the convenience of live chat overall.” – Jasmina Duric, Manager of E-Services and Support Department

While live chat is improving CX and customer satisfaction, it’s also helping to improve credit union member engagement as LMCU’s agents can connect with more potential and current members who were put off from reaching out via phone.

After more than five years of success with Comm100 Live Chat, LMCU knew that their member support could be further improved by taking the next step in credit union digital transformation – introducing automation to provide 24/7 support. With Comm100 AI Chatbot now integrated into Comm100 Live chat, LMCU are now available whenever their members need them, answering the most common member queries around-the-clock.

Cabrillo Credit Union

Cabrillo Credit Union is the primary financial institution for U.S. Border Patrol employees. To start their digital transformation journey, Cabrillo first introduced Comm100 Live Chat as they recognized their members’ support expectations were shifting. As Kelli Davis, Cabrillo’s Assistant VP of Member Support, explained, they wanted to introduce live chat “to make sure that we stayed relevant with our members throughout the whole country and give them an alternate channel to communicate with us – rather than just relying on phone.”

With live chat in place, Cabrillo’s members now receive much faster support on a channel that they feel comfortable using. In fact, as a result of implementing live chat, Cabrillo’s phone wait times dropped from 45-50 seconds to just 15 seconds.

“It wasn’t much of a surprise to see the younger generations engaging first… but we are starting to see Baby Boomers learning the technology and using the chat. It does require some patience by our agents as they discover the technology, but our members appreciate it, and they love using it.” – Kelli Davis, Cabrillo Credit Union, Assistant VP of Member Support

With the successful rollout of live chat, in 2020 Cabrillo took the next step in credit union digital transformation by introducing Comm100 AI Chatbot. Outside of their business hours, the chatbot manages common member inquiries, providing around the clock support that otherwise wouldn’t be possible.

Cabrillo’s introduction of live chat and chatbot has increased member engagement and seen increased usage year-over-year. Members are happy that their questions now receive quick answers without any wait time. The chatbot is equally popular among Cabrillo’s agents, whose workload is reduced.

“We love our chatbot. We were initially slightly nervous about it… so we started out with about 10% of incoming chats being answered by the bot. However, we soon saw the successes and where it needed correcting, and we now have it set managing about 30% of incoming chats.” – Kelli Davis, Cabrillo Credit Union, Assistant VP of Member Support

Wrap Up

With the benefits of digital transformation clearer than ever, the time for credit unions to introduce digital CX is now. While the prospect of digital transformation can seem daunting, it doesn’t need to be. Like the credit unions looked at here, digital transformation is a gradual process that begins with the right tools and the right partners.

To find out how you can begin your journey towards digital transformation, take a look at our full guide below:

Improving credit union member engagement

Member engagement is the bedrock of any successful credit union. Read this complete guide to find out how you can take it up a level with digital support.

Read more

Learn more