Over the last two decades, financial institutions have undergone a complete digital transformation. From e-transfers to contactless credit cards, there’s no denying the overwhelming shift to digital transactions.

Right alongside that shift, how and where customers access support has also changed. 79% of customers prefer live chat thanks to the immediacy it offers compared to other channels. But how do financial institutions get started? Here are some best practices to get you off the ground.

Features

Live chat offers your team a whole host of new capabilities. Mapping your team’s customer experience goals to overall company targets will help define which features you should pay attention to. Here are some tips to start you off:

- Design an effective chat button

A well-designed chat button is one of the most important but often overlooked features of live chat. Not only can it affect a customer’s user experience, but it also helps you attract and engage with customers better. Your chat button should be easy to locate and access, and visible enough without being too busy or distracting. It also has to be 100% on-brand.

- Measure customer feedback

Post-chat surveys are an effective tool to collect customer feedback after a chat ends. Listening to your customers is an invaluable part of any customer experience strategy. Keep your survey short and sweet and use Net Promoter Score (NPS) or a five-point scale to get the best responses.

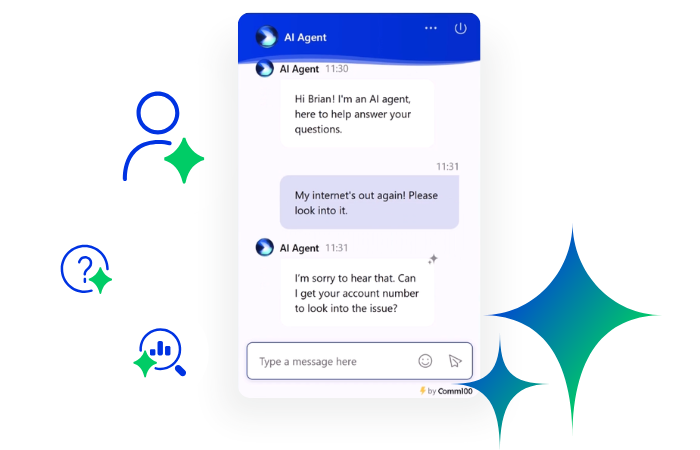

- Automate your chats

Set it and forget it with live chat routing rules. Automatically directing queries to the right agent in the right department means no more ‘transfer tag’. Route credit card inquiries to the credit department and insurance claims to the insurance department, where they belong. This will save time and effort for both your customers and your agents.

Deployment Options

Keeping customer data safe and adhering to industry regulations is expected of all financial institutions, regardless of size. When deploying live chat consider whether a cloud-based or on-premise solution is right for you:

1. Cloud-based

A cloud-based solution is hosted and maintained by the vendor and requires no upkeep on your end. Live chat implementation on a cloud-based solution is as simple as adding a few lines of code to your website. With this setup you’ll be up and running in minutes, enjoying automatic updates from the vendor with the smallest upfront investment.

2. On-premise

On-premise deployment may be mandated by your business policies. This deployment option grants you complete autonomy over hosting infrastructure and data management. While you will enjoy the comfort of your own in-house security, the trade-off is higher implementation and ongoing maintenance costs.

Here’s a quick run-down of the two options:

| Cloud-based |

On-premise |

| Hosted and maintained by the vendor |

Hosted and maintained on your own data servers |

| Data is stored on vendor servers |

Data is stored on your own servers |

| Automatic, more frequent software upgrades |

Less frequent, manual upgrades with scheduled maintenance |

| Only pay for agent licenses |

Pay for licenses, support, and maintenance |

Agent Training

When training your agents on live chat, it’s important to set the ground rules: Which questions can agents answer before escalating? What is the procedure for authenticating a customer through chat? What kind of policies should your agents follow in a high-risk situation? These are all questions you should consider when rolling out chat for your financial institution.

Some institutions will answer the same types of questions via chat as over the phone. Others will choose to direct transaction related queries to phone or in-person depending on verification and security needs.

If you choose to process account-related transactions (think: paying off a credit card or a bill) through chat, your agents should be able to authenticate the account according to a standardized identity verification process while observing all required security protocols and complying with regulatory requirements including PCI DSS.

Some financial institutions implement the same verification processes for chat as they do for phone (e.g. asking security questions). Others use features unique to live chat, like locating geographical information to identify potential scams or fraud.

For example, if a customer’s IP is from China, but their address on file is in the United States, this could raise a potential red flag. If this customer has never visited China and this activity is not in line with their usual account behavior, their account may be compromised.

In this type of high-risk situation, you should outline a formalized process where agents can escalate to the appropriate department. A safe practice is allowing visitors to chat only when they’ve signed into their online banking account.

Test it, then test it again

With any new customer-facing communication tool, the most important best practice is to test it before formally rolling it out. When rolling out live chat, test your new software internally in a sandbox environment. Have your agents alternate “customer” and “agent” roles with each other as a training exercise.

Don’t overload your agents with too much information when you first start off. Take note of policies that may be confusing and revise them. Keep an open mind and be flexible when testing – your usage of live chat will evolve as your agents become more familiar with customer needs.

Wrap-up

The seismic shift in customer expectations has led to a digital revolution for banks, credit unions, insurance companies, and other financial institutions. More and more consumers are managing their finances online and demanding that their service providers keep up, particularly when it comes to customer service.

Live chat has given financial institutions the chance to enhance the quality of service they offer customers, with real-time support that’s quick, easily accessible, convenient, and confidential. It’s a vital component of a comprehensive, multichannel, digital customer experience strategy that will ensure your organization delivers on changing customer expectations.

Powerful live chat software

Offer real-time, personalized, efficient support that your customers and agents will love at 1/3 the cost of voice support.

Learn more

Comm100 Live Chat