Financial institutions across the world are taking advantage of new digital technologies to improve customer experience (CX) and engagement. If credit unions want to keep up, it’s crucial they join them on this path towards digital transformation. As C.D Howe Institute, the policy research organization, summarized:

“Unless credit unions are directly involved in the development of the new digital offerings, they will be left behind.”

Member expectations are high, and ever increasing, but digital channels can help credit unions to meet these expectations. We’ve looked at how live chat can help credit unions improve member engagement, but to take this to the next level, chatbots are essential. With a chatbot at hand, credit unions can provide superior experience to their existing members, as well as attract younger future members.

In this blog, we’ll look at the top 3 reasons why chatbots for credit unions are key to improving member experience and engagement, and why more and more credit unions are adopting them.

1. Current members are digitally-active

The average age of a credit union member is 47. Knowing this, many credit unions assume that most of their members prefer traditional communication such as telephone and are not as comfortable with digital services and channels. However, this is becoming less true by the day.

In the 7th edition of the CFI Group Credit Union Satisfaction Index (CUSI) survey, it was found that 81% of credit union members had visited their union’s website in the past 60 days. Moreover, 90% check their balance online or via their mobile app at least once a month, 71% to pay bills, and 68% to transfer funds.

This move towards digital services has been accelerated by Covid-19. 65% of Gen X, those aged 42 to 57, say they “expect to spend more time online after the pandemic than I did before”. 70% of Gen Xers agree that “Covid-19 has elevated my expectations of companies’ digital capabilities”. As this generation becomes more accustomed to digital services, they are becoming comfortable using these channels to communicate with their credit union, and are enjoying better member experiences as a result.

Lake Michigan Credit Union (LMCU), serving nearly half a million members across the United States, has received excellent feedback from their members after introducing live chat and chatbots to their member services. Beginning with the introduction of live chat, members immediately responded to the convenience of digital support channels:

“We’ve received nothing but positive responses. Members love the ease of being able to be anywhere and connect with us over chat instead of having to go into a branch or calling in. They really enjoy the convenience of live chat overall.”

LMCU, Jasmina Duric, Manager of E-Services and Support Department

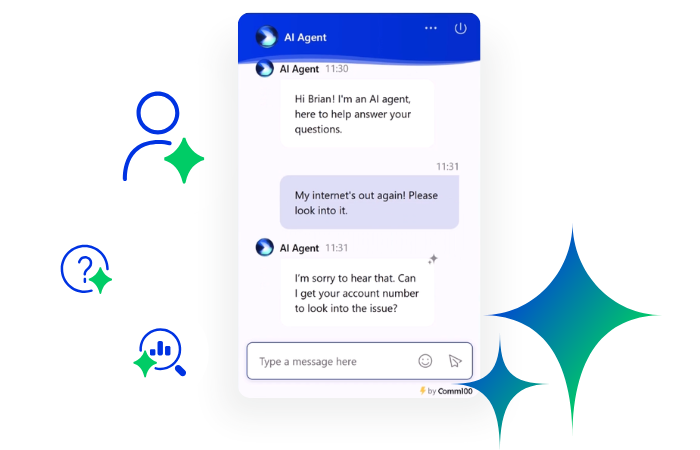

Seeing this success, LMCU worked with Comm100 to set up an AI chatbot so they could provide 24/7 support. The chatbot can handle the most common requests without any agent intervention, allowing them to resolve issues outside of LMCU’s traditional hours. During standard business hours, the bot has also led to lower wait and response times.

As the chatbot handles an unlimited number of straightforward, repetitive requests, agents can take on complex issues, providing more personal support. Those members that would rather speak to an agent are also given the option to do so. LMCU’s bot is proving to handle not only the needs of current members, but future members too – leading us to the next reason that chatbots for credit unions are key.

2. Future members demand digital support

With 70 million Millennials (born between 1981–1996) and 86 million post-Millennials (Gen Z and beyond, born after 1996) in the US alone, it is safe to say that these younger generations will comprise the majority of future credit union memberships. These generations have even higher digital support expectations. A survey of 1,000 American consumers by Zafin showed that for Gen Z and Millennials choosing a bank, the most important factor is “online and mobile banking capabilities”.

Looking at the shifting trends in demographics, Credit Union Times states:

“…attracting the newest and soon-to-be largest pool of banking consumers will require credit unions to offer the same kind of experience these consumers are used to from other industries. Specifically, credit unions will need to offer digital, personalized solutions tailored to Gen Z’s needs and preferences.”

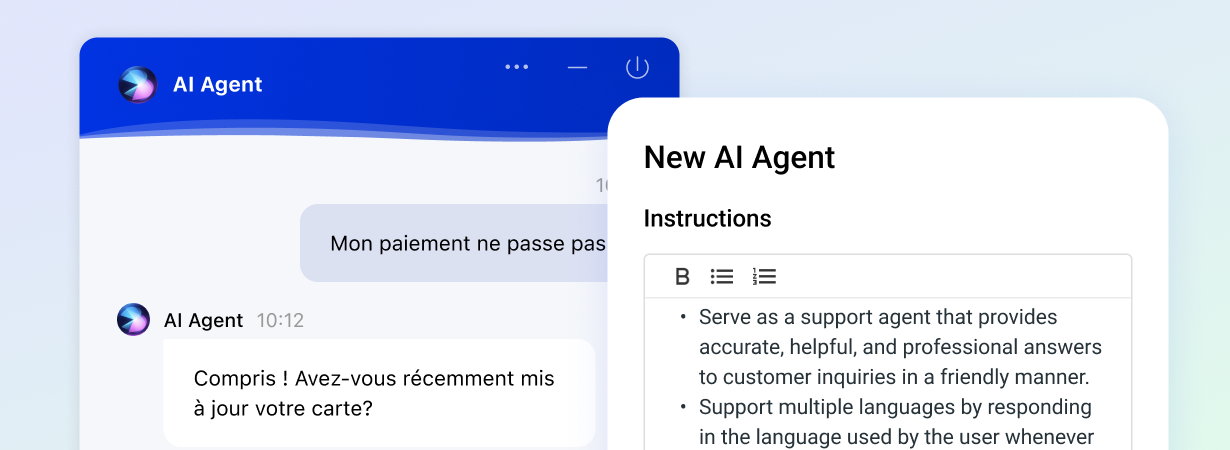

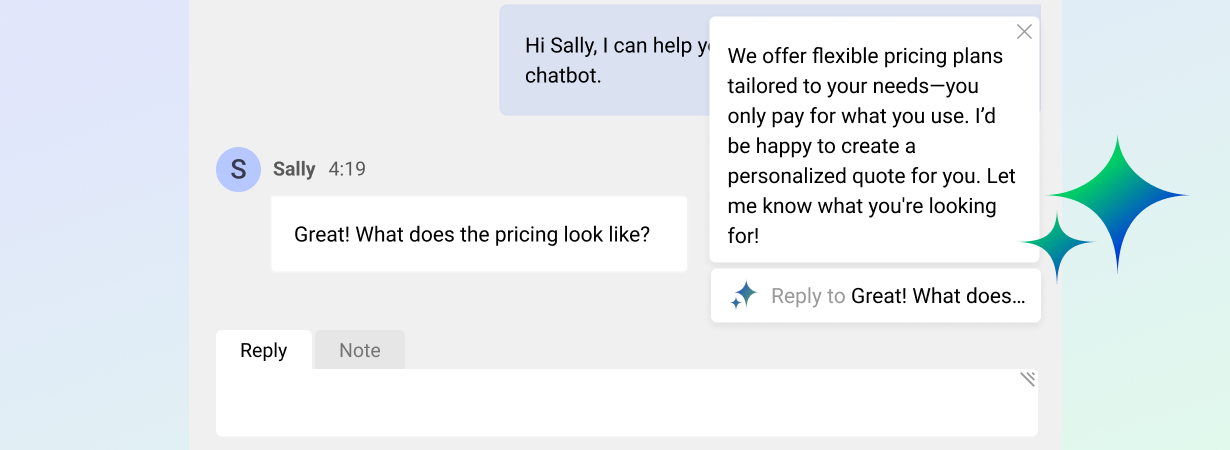

For Millennials and Gen Z, fast response times are crucial. In a survey, 81% of Millennials said that they “expect to interact with someone immediately when I contact a company”. All of this means that credit unions need to ensure the fastest response time possible, which takes us on to the next reason why AI for credit unions is key. By introducing an AI chatbot to live chat, members can receive immediate answers to their questions. If and when the chatbot can’t assist, the member can then be seamlessly routed to a live chat, passing along the member’s details and conversation with them so that they won’t need to repeat themselves.

3. Chatbots increase engagement

One of the greatest benefits of chatbots for credit unions is the possibility to increase credit union member engagement. Member engagement can have a direct impact on income with research revealing that engaged credit union members spend 22% more than non-engaged members. Engagement also plays a significant role in maintaining members. 43% of members don’t renew because of a lack of engagement with their credit union – up from 37% in 2018, showing just how important engagement is to today’s credit union members.

Chatbots are the perfect tool to increase engagement because they are always-on. Whenever a member wants to connect, they are there to provide information and support. This can be seen in the example of Cabrillo Credit Union, who transformed their member engagement using an AI chatbot.

Following the successful rollout of live chat to their members, Cabrillo introduced an AI chatbot to handle common questions and provide 24/7 support to members outside of standard business hours:

“We love our chatbot. We were initially slightly nervous about it… so we started out with about 10% of incoming chats being answered by the bot. However, we soon saw the successes and where it needed correcting, and we now have it set managing about 30% of incoming chats.”

Kelli Davis, Assistant VP of Member Support, Cabrillo Credit Union

The ability for Cabrillo to provide members with around-the-clock support was only made possible through the introduction of a chatbot. Using live chat and AI for credit unions, members can stay engaged with their union while seeking help on their own terms.

Improving credit union member engagement

Member engagement is the bedrock of any successful credit union. Read this complete guide to find out how you can transform your engagement strategy with digital support.

Read more

Learn more